BETA Technologies Targets the Public Markets with Electric Aviation Vision

BETA Technologies, Inc., the Vermont-based aerospace startup pioneering all-electric aircraft, has officially filed for its IPO and is preparing to list on the New York Stock Exchange under the ticker BETA. The company is offering 25 million shares of Class A common stock at an estimated range of $27–$33 per share, which would raise approximately $750 million at the midpoint. Based on 218,893,645 shares outstanding after the offering, BETA’s implied market capitalization at the midpoint of $30 per share is approximately $6.6 billion. Lead underwriters include Morgan Stanley, Goldman Sachs, BofA Securities, Jefferies, Citigroup, and TPG Capital, joined by Cantor, BTIG, and Needham. Founder and CEO Kyle Clark will retain over 63% of voting power through super-voting Class B shares, ensuring founder-led control after the IPO. Cornerstone investors—AllianceBernstein, BlackRock, GE Aerospace, Ellipse Holdings, and Federated—have indicated interest in purchasing up to $300 million worth of stock.

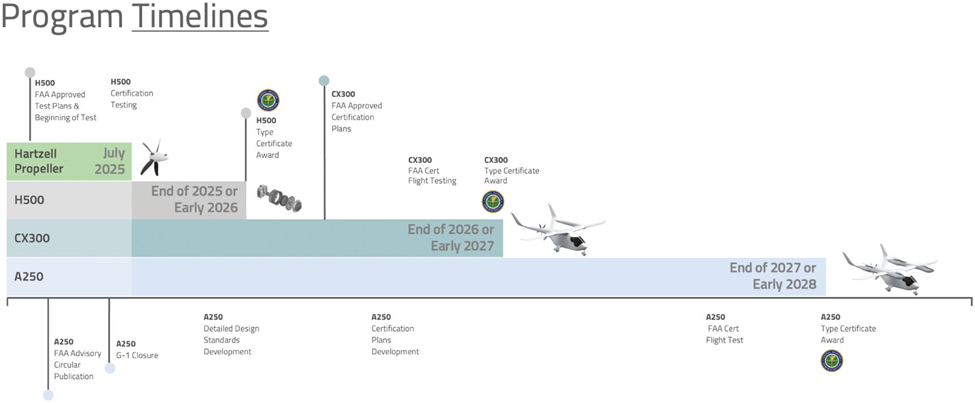

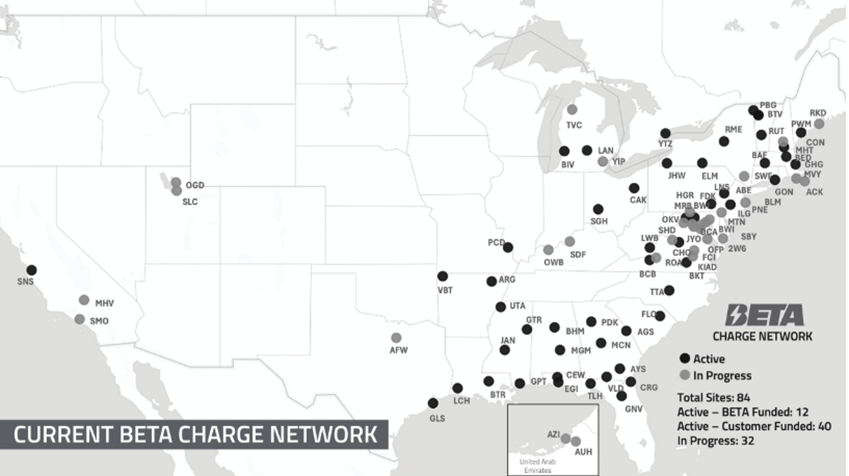

BETA has built a vertically integrated electric aviation platform spanning aircraft design, propulsion systems, batteries, charging infrastructure, and digital fleet management software. Its flagship lineup includes the ALIA CTOL (CX300), a six-passenger conventional take-off aircraft with a 215-nautical mile range, targeted for FAA certification in 2026/27; the ALIA VTOL (A250), a vertical take-off aircraft with a 560-unit backlog and certification expected by 2027/28; and the ALIA Defense VTOL (MV250), a military variant capable of carrying a 2,000-pound payload with autonomous capability, priced between $5–10 million. A larger 19-seat regional aircraft is also in development. Beyond its own aircraft, BETA sells electric motors, batteries, and charging systems to aerospace and defense customers. It has already deployed 51 high-speed airport charging stations across the U.S., with customers and partners including UPS, United Therapeutics, Bristow, Air New Zealand, Metro Aviation, and the U.S. Military. GE Aerospace, both a partner and $300 million equity investor, is co-developing hybrid-electric propulsion with BETA — a key differentiator as defense and civil applications converge on hybrid systems.

BillionToOne cites a $100 billion annual U.S. market opportunity across prenatal and oncology testing. Its growth trajectory highlights both scale and efficiency: more than one million tests accessioned since launch, with over 225 million covered lives under payor contracts. The company has also demonstrated improving unit economics, with gross margins climbing steadily as volumes expand.

Financially, the numbers highlight a rapid path toward profitability. Revenue grew from $71.7M in 2023 to $152.6M in 2024, and continued momentum delivered 82% year-over-year growth in the first half of 2025. Gross margins surged from 24% in 2023 to 65% in H1 2025, reflecting the scalability of its smNGS platform. Losses are narrowing quickly, with net loss shrinking from $82.6M in 2023 to just $4.2M in the first half of 2025

The company operates a 188,000 sq. ft. production facility in Vermont capable of scaling to 300 aircraft per year, with permits secured to nearly double capacity. In September 2025, BETA raised $422 million in a Series C-1 financing, with GE Aerospace leading the round.

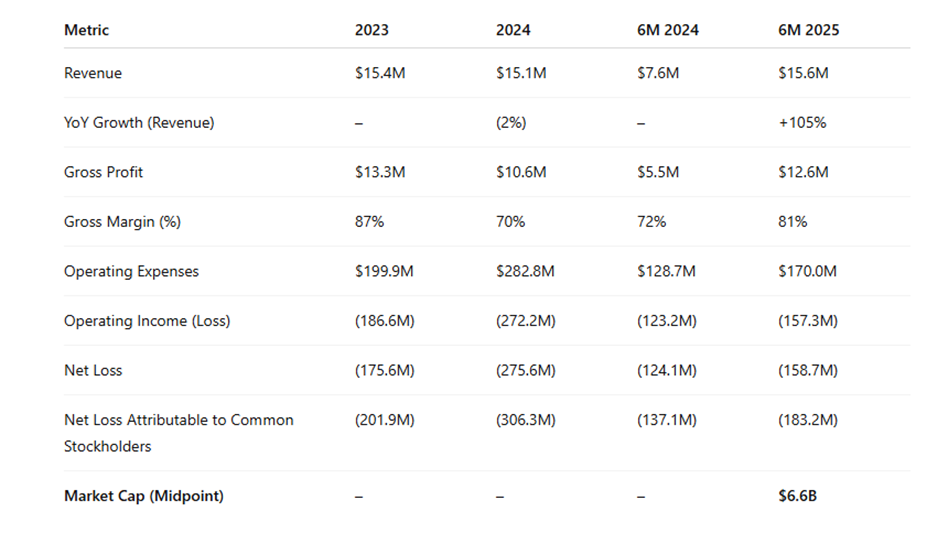

While revenue has held steady around $15 million annually, gross margin improved to 70% in 2024 and rose above 80% in the first half of 2025, reflecting the mix of service revenue and technology sales. However, net losses exceeded $300 million in 2024 and remain significant, highlighting the capital-intensive path to certification and commercialization.

Looking ahead, BETA’s growth strategy hinges on achieving FAA certification for its aircraft and propulsion systems, followed by validation with EASA, Transport Canada, and CAA New Zealand to serve international customers. The company plans to drive long-term value through not only aircraft sales but also recurring revenue from battery replacements, aftermarket services, charging infrastructure, and its digital fleet management platform, “BETA Operate.” Defense remains a critical pillar, with the ALIA Defense VTOL positioned for U.S. Army and Marine Corps programs focused on contested logistics and resupply.

The electric aviation sector is crowded with players such as Joby Aviation, Archer Aviation, Lilium, and Eve Air Mobility, many of which are also pre-revenue and awaiting FAA certification. BETA’s vertically integrated model, national charging network, and partnership with GE Aerospace provide competitive advantages, but like its peers, the company’s future rests on meeting certification milestones and proving scalability.

At IPO, BETA is presenting investors with a vision of sustainable aviation backed by recurring aftermarket economics. While losses are expected to continue for several years, the company is positioning itself as one of the most comprehensive bets in electric aviation.

Bottom Line:

From IPO Prophet’s perspective, BETA’s IPO will test investor appetite for aerospace disruptors after a wave of SPAC-era eVTOL names struggled in public markets. With cornerstone investor backing and a strong industrial partner in GE Aerospace, BETA may stand apart. Still, the path to FAA certification in 2026/27 will ultimately determine whether this story takes flight.

BETA will take off the week of November 3rd, 2025.