BillionToOne Brings Precision Diagnostics to Wall Street with IPO

BillionToOne, Inc., a precision diagnostics innovator based in Menlo Park, California, has filed to go public on the Nasdaq Global Select Market under the ticker BLLN. The company is offering 3,846,000 shares of Class A common stock at an expected price range of $49.00 to $55.00 per share. At the midpoint price of $52.00, the IPO is expected to raise approximately $200 million in gross proceeds. Lead underwriters include J.P. Morgan, Piper Sandler, Jefferies, William Blair, Stifel, Wells Fargo Securities, and BTIG.

After the offering, BillionToOne will have about 44.0 million total shares outstanding (39.5M Class A plus 4.55M Class B), which gives the company an implied market cap of approximately $2.3 billion at the midpoint of the offering range.

Founded in 2016 by scientists Oguzhan Atay and David Tsao, BillionToOne has pioneered a single-molecule next-generation sequencing (smNGS) platform that enables ultra-sensitive detection of genetic variants. Its flagship prenatal product, UNITY, provides fetal risk assessment for conditions such as cystic fibrosis and sickle cell disease without requiring paternal samples. In oncology, the company has launched Northstar Select (for cancer therapy selection) and Northstar Response (for monitoring treatment efficacy), both of which are gaining traction in clinical adoption.

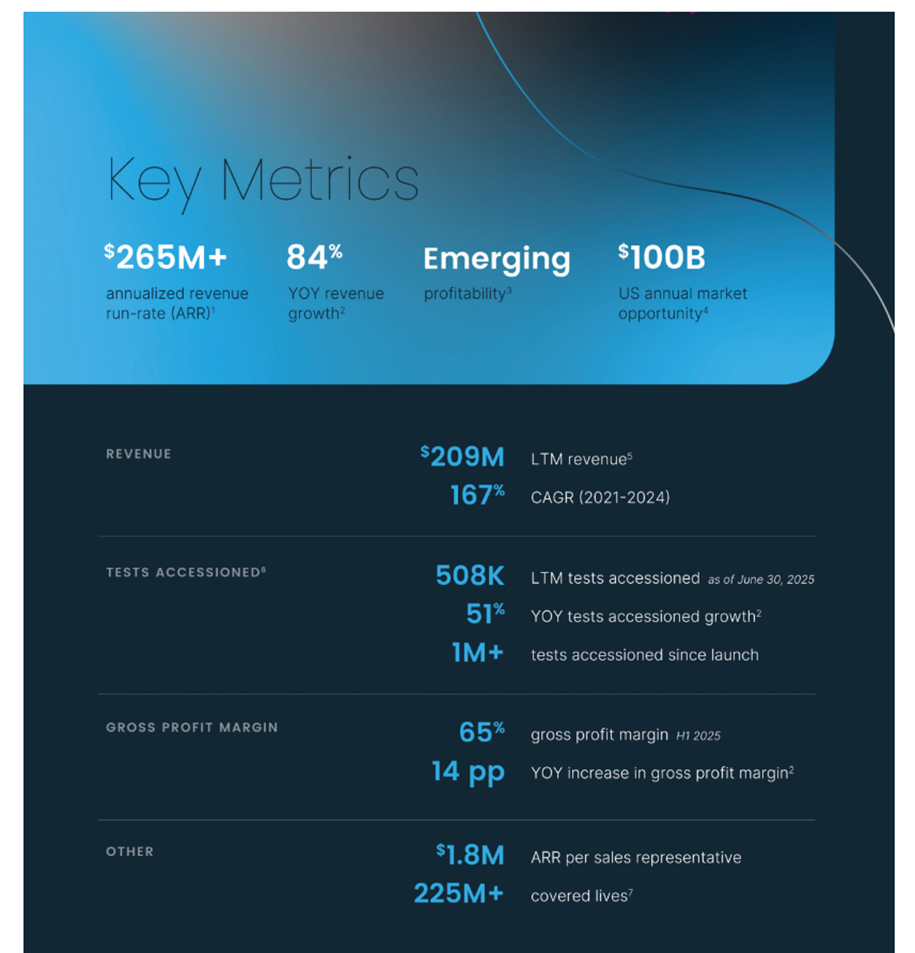

BillionToOne cites a $100 billion annual U.S. market opportunity across prenatal and oncology testing. Its growth trajectory highlights both scale and efficiency: more than one million tests accessioned since launch, with over 225 million covered lives under payor contracts. The company has also demonstrated improving unit economics, with gross margins climbing steadily as volumes expand.

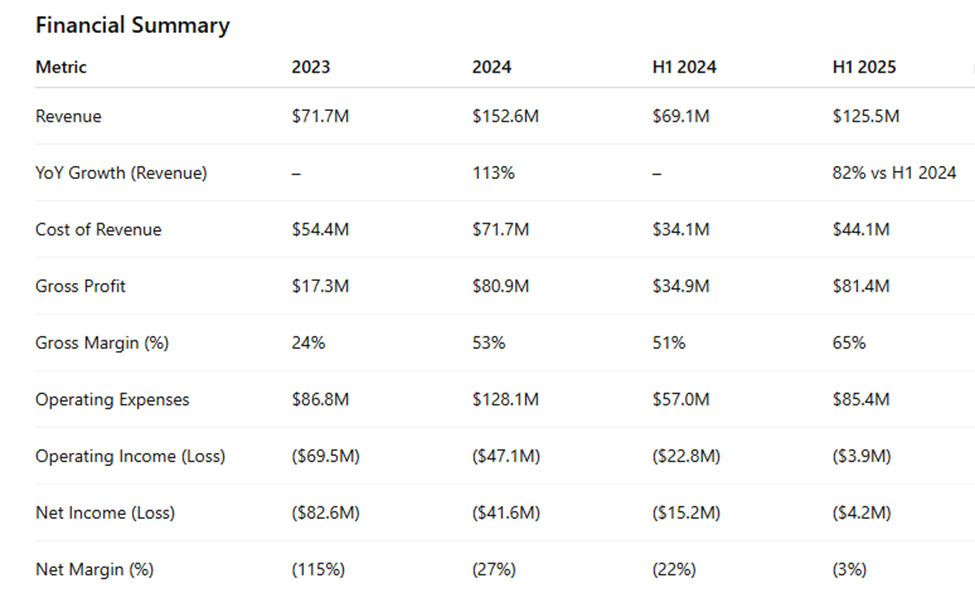

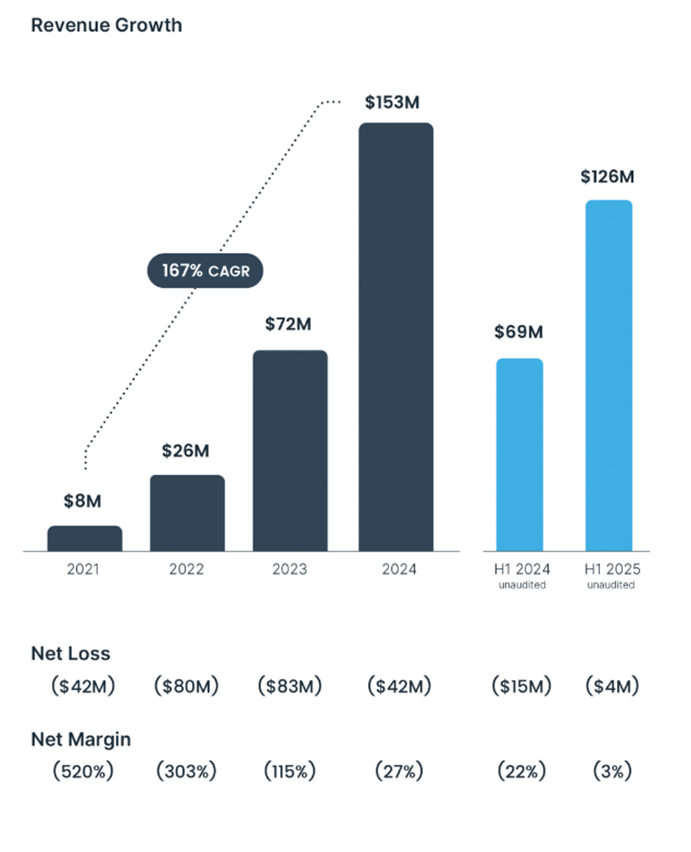

Financially, the numbers highlight a rapid path toward profitability. Revenue grew from $71.7M in 2023 to $152.6M in 2024, and continued momentum delivered 82% year-over-year growth in the first half of 2025. Gross margins surged from 24% in 2023 to 65% in H1 2025, reflecting the scalability of its smNGS platform. Losses are narrowing quickly, with net loss shrinking from $82.6M in 2023 to just $4.2M in the first half of 2025

Bottom line:

BillionToOne is positioning itself not just as a diagnostics player, but as a category-defining healthcare company with disruptive technology and accelerating financial performance. Investors will be weighing the promise of its breakthrough platform and growing test adoption against the risks of operating in a highly competitive and capital-intensive diagnostics market.

BillionToOne will hit the public markets the week of November 3rd, 2025.